Central issues:

- Nvidia figures Q4 deals of $37.5 billion, somewhat above investigator assesses yet underneath the most noteworthy projections.

- Blackwell chips, promoted for quicker artificial intelligence model preparation, are presently in full creation in the midst of supply difficulties.

- Gross edge plunges to 73%, however a bounce back is normal as creation scales.

- Server farm income copies to $30.8 billion, driven by request from cloud suppliers like Microsoft and Amazon.

Nvidia’s Development Filled by man-made intelligence, Yet Difficulties Loom

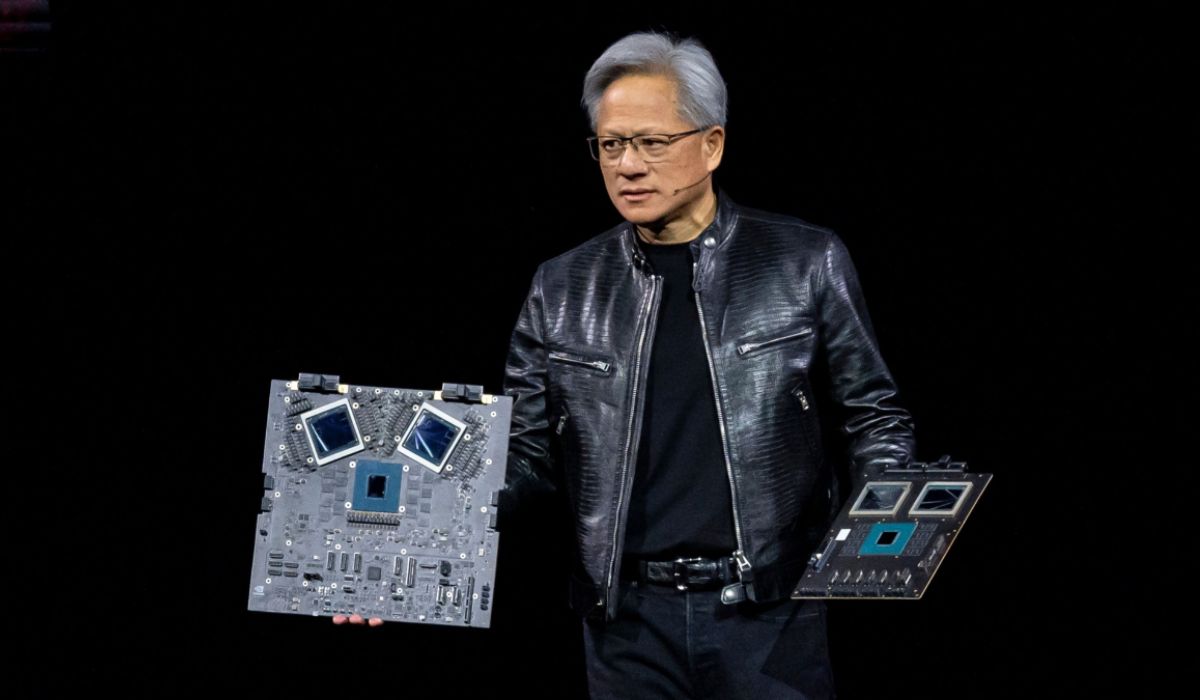

Nvidia Organization, the world’s most important chipmaker, guaranteed financial backers of proceeded with development with its profoundly expected Blackwell chips now in full creation. Talking after the arrival of its financial Q3 results, Chief Jensen Huang noticed that while interest for simulated intelligence items stays hearty, higher creation costs for Blackwell have briefly burdened net revenues.

The Blackwell chip, intended to speed up artificial intelligence model preparation and deduction, has been conveyed to significant accomplices, as indicated by Huang. The rollout, be that as it may, faces supply limitations, with request expected to dominate accessibility for a few quarters. Regardless of this, Nvidia is certain that scaling creation will further develop productivity.

Monetary Execution: Solid Yet Under a microscope

For financial Q3, Nvidia detailed income of $35.1 billion, a 94% expansion year-over-year, surpassing examiners’ assumptions for $33.25 billion. Barring explicit things, benefit came to $0.81 per share, beating appraisals of $0.74.

Nvidia’s server farm division, its biggest income driver, multiplied its pay from a year prior to $30.8 billion, beating Money Road gauges. Be that as it may, organizing income inside the unit declined consecutively, and dependence on a little gathering of cloud suppliers — Microsoft, Amazon, and others — rose to half of the division’s income.

For Q4, Nvidia projects deals of $37.5 billion, simply over the normal investigator gauge of $37.1 billion however underneath the most hopeful assumptions for $41 billion. The organization’s gross edge is supposed to decline from 75% to 73%, however CFO Colette Kress showed a re-visitation of mid-70% edges by mid-2025.

Artificial intelligence Request Fills Nvidia’s Authority

Nvidia’s ascent as the forerunner in simulated intelligence equipment comes from its gas pedal chips, urgent for preparing and running simulated intelligence models like OpenAI’s ChatGPT. The organization has quickly expanded its contributions, wandering into systems administration, programming, and completely incorporated PC frameworks to help the computer based intelligence unrest.

“The period of artificial intelligence has arrived, and it’s huge and different,” Huang commented, accentuating Nvidia’s part in propelling artificial intelligence across businesses and government areas.

Difficulties and Standpoint

While Nvidia keeps on dominating contenders like Intel and AMD, it faces examination over inventory network difficulties and reliance on significant cloud clients. Financial backers are quick to see more extensive reception of computer based intelligence arrangements across ventures to lessen Nvidia’s dependence on a couple of key clients.

Regardless of momentary obstacles, Nvidia’s direction stays solid, with its creative items and obligation to artificial intelligence situating it as a vital participant in the computerized future.